@The Reformed Libertarian, CJay Engel writes on Ethics and Self-Interest: Mises, Clark, Piper, and Rand which strikes a similar note as my old post Self-Interest.

Category: economics

The Founding Fables of Industrialised Agriculture

Once again, the debate over GMO’s is not a debate over how government should regulate the harmful effects of profit driven business. It is a debate over how government has enabled crony capitalism to crush competition:

So the best way by far to supply carotene (and thus vitamin A) is by horticulture – which traditionally was at the core of all agriculture. Vitamin A deficiency is now a huge and horrible issue primarily because horticulture has been squeezed out by monocultural big-scale agriculture — the kind that produces nothing but rice or wheat or maize as far as the eye can see; and by insouciant urbanization that leaves no room for gardens. Well-planned cities could always be self-sufficient in fruit and veg. Golden Rice is not the answer to the world’s vitamin A problem. As a scion of monocultural agriculture, it is part of the cause. Syngenta’s promotion of it is yet one more exercise in top-down control and commercial PR.

…The real point behind GMOs is to achieve corporate/ big government control of all agriculture, the biggest by far of all human endeavours… The technology itself is esoteric so that only the specialist and well-endowed can embark on it – the bigger the better. All of the technology can be, and is, readily protected by patents. Crops that are not protected by patents are being made illegal. Only parts of the EU have so far been pro-GM but even so the list of crops that it allows farmers to grow – or any of us! – becomes more and more restricted. Those who dare to sell the seed of traditional varieties that have not been officially approved can go to prison. Your heritage allotment could soon land you in deep trouble.

…Yet we have been assured, time and again, that there is no alternative; that without high tech, industrialized agriculture, we will all starve. This is the greatest untruth of all; though it has been repeated so often by so many people in such high places that it has become embedded in thezeitgeist. Whether the officially sanctioned untruths spring from misconception or from downright lies I will leave others to judge. But in either case, their repetition by people who have influence in public affairs, is deeply reprehensible…. Professor Hans Herren, President of the Millennium Institute in Washington, points out that the world already produces enough staple food to support 14 billion – twice the present number. A billion starve because the wrong food is produced in the wrong places by the wrong means by the wrong people – and once the food is produced, as the Food and Agriculture Organization of the UN (FAO) has pointed out, half of it is wasted.

Just one more example of the state creating a problem so they can pronounce themselves the only savior to the problem.

The resulting surpluses are then fed to livestock. Livestock that could, incidentally, be fed in more than adequate numbers if we made better use of the world’s grasslands, which account for about two-thirds of all agricultural land… “Demand” (in this scenario) is judged not by what people actually say they want (who ever said they wanted wheat-based biofuel, or cereal-fed beef rather than grass-fed beef?) but by what can be sold by aggressive PR and successfully lobbied through complaisant government.

The American Economy is Not a Free-Market Economy

The result of this governmental takeover of the economy has predictably been dire. “Many of the new mega rich of the 1990s and 2000s got their wealth through their government connections. Or by understanding how government worked. This was especially apparent on Wall Street. … This was all the more regrettable because, in a crony capitalist system, the huge gains of the few really do come at the expense of the many. There was an irony here. Perhaps Marx had been right all along. It was just that he was describing a crony capitalist, not a free price system, and his most devoted followers set up a system in the Soviet Union that was cronyist to the core.” (p. 17)

…Cronyism extends far beyond the financial sector. Lewis has for many years been active in the natural health movement, and he is thus keenly aware of the manifold ways in which crony capitalism risks our lives, health, and safety in pursuit of profit. Shunning a genuine free market, the predators strike at products that, if widely distributed, would threaten their ill-gotten gains. “In general, the FDA maintains a resolutely hostile stance toward supplements. It will not allow any treatment claims to be made for them, no matter how much science there is to support it, unless they are brought through the FDA approval process and become drugs. … Who can afford to spend up to a billion dollars to win FDA approval of a non-patented substance? The answer is obvious: no one. So the real FDA intent is simply to eliminate any competition for patented drugs, since these drugs pay the Agency’s bills.” (p. 171)

Thoughts on the VFX Crisis

Thoughts on the VFX Crisis is the best article I have read dealing with complaints being made by those in the VFX industry. I recommend the read.

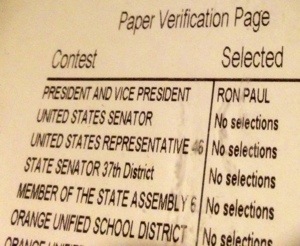

I Voted Today

I voted today, and here is one of a few reasons why it didn’t matter:

Bungee Jumping and Investing

A while ago I wrote a post called What Caused the Financial Meltdown? A Guide to Understanding the Collapse in 3 Hours, in which I wrote:

@1:19:45 black woman “I’m being held accountable for my bad choices. But who in that industry is being held accountable?… I’m stupid, but you’re guilty. You’re literally guilty.” Wow. And she’s not guilty for lying? It is this absolute lack of personal responsibility that creates this mess in the first place. People naively think we have reached a certain place in the progress of society where we should no longer have to actually worry about making catastrophic, bad decisions. There will always be a safety net, so I don’t have to worry. This is what “moral hazard” refers to. It is this idea that you are not really at risk for decisions that you make in life. There will always be a safety net to catch you or a safety regulation to keep you from making bad decisions. For example, see Schiff’s comments about FDIC @38:13.

A news report I read this morning reminded me of what I said above.

On Dec. 31, Australian tourist Erin Langworthy became one of thousands of people to try bungee-jumping off the bridge that connects Zimbabwe and Zambia, within sight of the tourist mecca Victoria Falls. It’s 364 meters of sheer gravitational pleasure, followed by a gut-wrenching jerk just feet above the rapids below. The only problem, for Ms. Langworthy, is that her bungee cord broke and she fell into the Zambezi, which, in its quieter areas, is infested with crocodiles.

The reporter went on to make a few comments about being safe in Africa:

One: Tourists who come from litigious societies such as the United States may have an assumption that an activity is safe, because it is allowed to exist. Such an attitude may be reasonable in the US or Australia, but it doesn’t necessarily work in a country such as Zambia, where civil court cases can take decades to resolve.

Living in a nanny-state takes it’s toll on a person’s common sense and personal responsibility. But how could we ever survive without a nanny-state to protect us?

Langworthy’s plunge reminded me of the anecdote of a friend in Johannesburg, who took his clients on a year-end corporate junket to Victoria Falls. The last event was to be a bungee jump off the Victoria Falls bridge. All but one of the clients took the plunge. The one who didn’t jump had asked the bungee operator what would happen if the bungee cord breaks. The tour operator grinned: “We’ll replace it.”

Pope Talks Economics

Saw this article in the news last night: Pope Talks Economics

Pope Benedict XVI warned Thursday at the start of a visit to crisis-hit Spain that Europe won’t be able to emerge from its economic woes unless it realizes that economic policy cannot be guided by a profit-driven mentality alone.

He said the continent must take ethics into account and look out for the common good.

Of course, who better to define the common good for the entire continent than the Pope himself, right? Sounds like a good time to revisit John Robbins’ lectures:

- The Economic Thought of the Roman Church-State, John Robbins

- The Political Thought of the Roman Church-State, John Robbins

Ecclesiastical Megalomania: The Economic and Political Thought of the Roman Catholic Church (Paperback) $19.95

Click to enlargeJohn W. Robbins

Trade paperback, 326 pages, indexed, [1999 ] 2006The noted English political philosopher A. P. D’Entrèves argued that “it is hardly possible for the modern man to accept the system which St. Thomas founded…without renouncing the notion of civil and religious liberty which we have some right to consider the most precious conquest of the West.” Ecclesiastical Megalomania explains the conflict between Roman Catholicism and freedom in detail, relying on official Vatican pronouncements to demonstrate that Roman Catholicism is hostile to constitutional government, political and economic freedom, and the private property order. The “Mother Church” is the mother of feudalism, the corporative state, liberation theology, the welfare state, and fascism.

Contents: Part 1: Envy Exalted.

Private Property; The Universal Destination of Goods; Rerum Novarum: On the Condition of the Working Classes; Subsequent Encyclicals; Feudalism and Corporativism; Liberation Theology; The Redistributive State and Interventionism; Has the Pope Beatified Ayn Rand?

Part 2: Autocracy Adored.

Lord Acton on Roman Catholic Political Thought; Roman Catholic Political Theory; The Political Thought of Thomas Aquinas; Persecution, Inquisition, and Slavery; The Nineteenth Century; The Magisterium; Solidarity, Subsidiarity, and the Common Good; Fascism and Nazism; Totalitarianism; Strategy for Subverting a Republic; World Government; 2000: Jubilee, Punctuated by Apologies.

Appendices: The Donation of Constantine; The Vatican Decree of 1870; Bibliography; Index; Scripture Index

Measuring Time

How do you measure time?

I read an interesting article in Newsweek about Henry Kissinger’s new book about China and his diplomatic work there. Dr. K’s Rx for China (I recommend reading the whole article before reading the rest of my comments). Generally, the article is about the vast differences between Chinese thinking and American thinking and how that creates problems unknowingly. What stood out to me was the following quote:

The most profound insights of On China are psychological. They concern the fundamental cultural differences between a Chinese elite who can look back more than two millennia for inspiration and an American elite whose historical frame of reference is little more than two centuries old. This became most obvious in the wake of June 1989, when Americans recoiled from the use of military force to end the Tiananmen Square pro-democracy demonstrations. To Kissinger’s eyes, it was doubly naive to retaliate to this crackdown with sanctions: “Western concepts of human rights and individual liberties may not be directly translatable … to a civilization for millennia ordered around different concepts. Nor can the traditional Chinese fear of political chaos be dismissed as an anachronistic irrelevancy needing only ‘correction’ by Western enlightenment.”…

…“Chinese negotiators,” observes Kissinger in a passage that should be inwardly digested not just by American diplomats but also by American businessmen before they land in Beijing, “use diplomacy to weave together political, military, and psychological elements into an overall strategic design.” American diplomacy, by contrast, “generally prefers …c to be ‘flexible’; it feels an obligation to break deadlocks with new proposals—unintentionally inviting new deadlocks to elicit new proposals.” We could learn a thing or two from the Chinese, Kissinger implies, particularly Sun Tzu’s concept of shi, meaning the “potential energy” of the overall strategic landscape. Our tendency is to have an agenda of 10 different points, each one to be dealt with separately. They have one big game plan. We are always in a hurry for closure, anxiously watching the minutes tick away. The Chinese value patience; as Mao explained to Kissinger, they measure time in millennia.

One of the defining elements of Chinese culture, one of the primary reasons it stands out against American culture, is how they measure time. They measure it in millennia, rather than years or decades.

How do you measure time? Does your citizenship in the kingdom of God affect your measurement of time? I don’t just mean on Sundays, or on Wednesday nights. I mean on a daily, hourly basis. Does your measurement of time cause people to step back and notice, in the same way that Henry Kissinger steps back and observes the Chinese? Does your measurement of time affect your decision making in such a way that it beckons others to study you? Or is your decision making no different from the rest of the culture around you?

For many years, economists have studied what they have labeled “the Protestant Work Ethic”. Of course, they debate over what exactly this ethic is and why it was practiced, but the interesting point is that they noticed. They noticed something was different about these people in the wake of the Reformation. Protestant beliefs drastically effected their economics, their “human action” and decision making.

So while Americans measure time in years, or maybe decades, and the Chinese shock the world by measuring time in millennia, Christians are called to measure time eternally.

Jesus said, “Truly, I say to you, there is no one who has left house or brothers or sisters or mother or father or children or lands, for my sake and for the gospel, 30 who will not receive a hundredfold now in this time, houses and brothers and sisters and mothers and children and lands, with persecutions, and in the age to come eternal life. 31 But many who are first will be last, and the last first.” (Mark 10)

But don’t just look at the big ticket items like your house, family, and property – look at the little ticket items too. Take time to listen to this excellent sermon – a great example of measuring time eternally: Take Time to Be Holy

———

By the way, if you answered no to the questions above (and if we are honest, we must all answer no, not as we ought), then how can you change? How can you begin to measure your time eternally? The answer is not by making a resolution to do so. It will be of no help to write on a post-it-note “Measure time eternally”. If we want to actually measure time eternally, then we need to study the doctrines of Scripture that relate to eternity, and there are many (so study them all 😉 ) Have you put off a study of the end-times because it’s so confusing and because so many people disagree? While I can sympathize, I can also say you won’t make any progress if you never meditate upon the new heavens and the new earth. Here’s a great place to start: The Last Things According to Peter

Gary North Pulling Strings of the Antiunion Movement?

I read a rather bizarre article from the NYTimes a few days ago. It’s an unveiled attempt to discredit the antiunion movement by associating it with Gary North and those scary/threatening homeschoolers.

‘Christian Economics’ Meets the Antiunion Movement

“Not only do Reconstructionists believe that public employees should not have the right to organize, they believe that almost all of them should not be public employees,” writes Julie Ingersoll, of the University of North Florida, in the Web magazine Religion Dispatches. “Most of the tasks performed by those protesting the Wisconsin state budget would, in the biblical economics of North,” be privatized.

…Mr. McVicar believes that Professor Ingersoll’s attempted connection between Christian economics and the rallies in Madison is a bit tenuous. “Her insight has to be in my mind so heavily qualified as to make it almost nothing,” he said. But he concedes that it “has the most basic essence of truth,” given how widely Mr. North’s teachings have been disseminated on the Christian right.

As an aside, here is an interesting read on North, Rushdoony, and the Reconstructionist movement, written from outside of the movement: One Protestant Tradition’s Interface with Austrian Economics: Christian Reconstruction as Critic and Ally

What Caused the Financial Meltdown? A Guide to Understanding the Collapse in 3 Hours

I have been trying to find an efficient way to communicate and explain the causes of the financial meltdown. I have been driven by the fact that properly understanding the causes is crucial to preventing them again (and because it’s related to things like the recent health care reform), and by the fact that people don’t have a ton of time to read lots of articles and put everything together. But I think I have finally found a very helpful way of explaining everything in about 3 hours by watching 3 videos and comparing some notes.

In my quest to provide a simple, streamlined explanation of the financial meltdown, I came across CNBC’s documentary “House of Cards.” It does a pretty good job of simplifying the chain of events and connecting them with every day Americans, rather than leaving it all in the mystifying world of Wall Street. So the first thing you should do is watch House of Cards. Below are notes to follow along/review.

House of Cards

Host David Faber begins the entire show with the following statement (@8:30):

The economic crisis finds its roots in the U.S. housing market.

The entire financial meltdown is directly tied to the housing market. The remainder of the documentary attempts to show what happened in the housing market (and Faber’s thesis is that greed, specifically Wall Street greed, is to blame – but that’s only a half truth). The whole documentary is helpful in getting you to understand the links in the chain, you could really watch about 4 minutes of the beginning and end to learn all you need to know:

@10:00 [After 9/11] the outlook was bleak. The economy was still reeling from the dot com bust. And what the country needed was for Americans to start spending. Alan Greenspan made that easier. As Fed Chairman he controlled the country’s short term interest rates. The lower the interest rate, the cheaper it was for people to borrow money.

@1:27:55 Fed Chairman Alan Greenspan retired in 2006. Within a year, the age of euphoria he’d helped unleash would come to an end.

If you want the simplest, most basic explanation, you can stop right here.

It was a result of the Fed.

If you want a more detailed explanation, read/watch on.

Here is the chain of events Faber describes (below it will be a modified list with comments):

- September 11, 2001 terrorist attack shocked the economy and essentially put it on hold. People stopped transacting.

- Lack of transactions – people saving rather than spending – will destroy the economy.

- @10:18 “The outlook was bleak. The economy was still reeling from the dot com bust. And what the country needed was for Americans to start spending. Alan Greenspan made that easier. As Fed Chairman he controlled the country’s short term interest rates. The lower the interest rate, the cheaper it was for people to borrow money.”

- The Fed sharply lowered the interest rate.

- As a result, borrowing money became cheaper than it had been in a generation.

- President Bush told people to go out and spend money. If you don’t spend your money, the terrorists win.

- Americans took advantage of the lowest mortgage rates since 1971 and they started buying houses.

- This increased demand for houses drove the price of houses up. (This is the law of supply and demand)

- This increased cost of houses meant fewer people could afford them.

- Banks decided to make loans to these people.

- Getting a housing loan used to be very, very difficult (@14:30). People were subject to incredible scrutiny to decide if you could pay back the loan.

- “Our industry… has been driven by small and medium sized mortgage bankers that deal with Fannie and Freddie.”

- Fannie and Freddie, created by Congress, buy home loans from mortgage lenders.

- Fannie and Freddie then receive the mortgage payments from people. They pool this money and sell it in shares for investment called the “Mortgage Backed Security” that big institutions like pension funds learn to love.

- @16:50 “We were used to being led by Fannie and Freddie. We got our rules from those guys, and that’s what we did.”

- Fannie/Freddie in penalty box, Wall Street took over so that small mortgage loaners could “bend the rules” and make loans to people who couldn’t pay them.

- @18:40 “The mortgage market caught fire (grew) because the world was flushed with cash.” (It was flushed with cash because foreign countries who used to be poor became rich by being productive)

- Dallas the lender gave people loans that he knew couldn’t afford it. The only thing stopping him from doing it before was Freddie/Fannie’s rules. Wall Street didn’t have those rules.

- @23:00 In 2002 Bush pushes for more people to own homes.

- @24:30 “I didn’t actually understand all the terms in the paperwork, but I just trusted the broker.”

- @27:44 “I did ask, ‘How exactly is this going to work?’ She said ‘Oh we’re going to refinance in 5 years. You’ll be fine.’ Did I get more information? No.” -Her mortgage lender lied on the application about her income

- @28:30 Wall Street was profiting and so were these new home owners with cash from their homes, “thanks in large part to interest rate cuts engineered by Fed Chairman Alan Greenspan.”

- @33:30 “part of the problem here” is that “loan officers” had no training and were not regulated by the state

- @38:15 “It was a pretty shocking claim – that Wall Street would knowingly create a market for the worst kinds of mortgages.”

- “Wall Street became intoxicated by the sheer volume of mortgages they could repackage and sell, no matter how toxic the loan.”

- 39:25 Bush brags about new home construction highest in 20 years. “Home ownership rates the highest ever.”

- Greenspan encouraged mortgage industry to come up with new kinds of loans.

- which resulted in “Pay Option Negative Amortization Adjustable Rate Mortgage”

- @41:20 Mantra was that housing prices had not gone down one year since the Great Depression

- In order to divide up and sell loans, Wall Street had to get them rated

- AAA -> BBB, change in housing market made BBB “safer” – so they lowered standard for AAA

- Rating agency conflict of interest – paid by banks they were rating

- Nobody was paying attention to reliability of rating agencies

- Banks created “Collateral Debt Obligation” CDO – small pieces of lots of different mortgages. They were all betting on the continuing rise of housing prices.

- Norway bought CDOs.”The contents of which were a mystery to them.”

- @55:30 Fannie/Freddie plunged into the loans they once shunned (sub-prime).

- @56:30 “Why didn’t you stop yourself from giving out bad loans?” “Because I wouldn’t be able to compete because my volume would go to zero.” “Greed is hard to control, huh?” “There’s nobody there saying, ‘Stop it! We can’t do this anymore, even if we go out of business.”

- @1:01:34 There’s nothing the Fed could have done to prevent a collapse – that is aside from stopping the growth and causing a recession.

- Warning sign #1 – it was unregulated market

- Warning sign #2 – housing prices rising much faster than income

- Wall Street sellers were fresh out of college. When asked “What if these are bad and you can’t sell anymore?” He said “It will never stop.”

- @1:08:30 How do banks get people to buy CDOs with bad loans? Get them a AAA rating.

- @1:09:30 No one I met with thought it was remotely possible home prices could go down.

- @1:10:00 It was easy to break the rating rules and make a crappy loan a AAA. “There was not a lot of sophistication involved.”

- @1:11:40 Alan Greenspan couldn’t understand CDOs.

- Sub-prime loans started going bad.

- Wall Street stopped buying.

- Sub-prime lenders stopped lending.

- Nobody could get a loan.

- Which resulted in decreased housing demand.

- Which stopped rising housing prices.

- Which meant people could no longer refinance to keep up with their loans.

- @1:19:45 black woman “I’m being held accountable for my bad choices. But who in that industry is being held accountable?… I’m stupid, but you’re guilty. You’re literally guilty.”

- @1:22:45 “Norwhich still has no clue what they invested in.”

- @1:23:05 Wall Street sold all kinds of CDOs, not just mortgage backed CDOs. But when the mortgage CDOs went bad, people started to doubt, and their value went down.

- @1:23:40 Norway: “We have learned a lot. If things sound too good to be true, they are. I have learned not to trust nice man in Armani suits.”

- @1:24:46 “People borrowed too much. Lenders loaned too much. That will not correct itself until the Darwinian flush. Until there is a flush of people that can’t afford to pay these loans and they get wiped out and home values get back to a level people can afford them.

- Banks began failing.

- @1:28:00 Greenspan retired in 2006. “Within a year, the euphoria he helped unleash would come to an end.

- “They knew what they were doing. They weren’t dumb. It was simply a failure to get out at the right time.”

- Greenspan: We will be having this conversation again in the future. It will be a long time, but it will happen again. There is no law you can pass to stop it because the flaw is in our human nature.

Why the Meltdown Should Have Surprised No One

Now compare what you have just watched with Peter Schiff’s video. Take special note of his explanations as to why things happened. That is the most important question. Why? (After the video is my CNBC outline with added notes that implement Schiff’s insights)

Transcript of Schiff’s lecture: http://mises.org/daily/3493

CNBC Chain of Events + Notes

- September 11, 2001 terrorist attack shocked the economy and essentially put it on hold. People stopped transacting.

- Lack of transactions – people saving rather than spending – will destroy the economy. This assumption is the result of a particular economic theory called Keynesian. This has been the standard U.S. government theory for the last 100 years – but it is defunct. The assumption is false, but all that follows below is a result of this faulty assumption. The theory believes that the Federal Reserve plays an important role in getting people to spend, and thus saving the economy. This theory is most strongly opposed by Austrian economic theory.

- @10:18 “The outlook was bleak. The economy was still reeling from the dot com bust. And what the country needed was for Americans to start spending. Alan Greenspan made that easier. As Fed Chairman he controlled the country’s short term interest rates. The lower the interest rate, the cheaper it was for people to borrow money.”

- The Fed sharply lowered the interest rate.

- As a result, borrowing money became cheaper than it had been in a generation.

- President Bush told people to go out and spend money. If you don’t spend your money, the terrorists win. This is Keynesian economics rearing it’s ugly head again.

- Americans took advantage of the lowest mortgage rates since 1971 and they started buying houses.

- This increased demand for houses drove the price of houses up. (This is the law of supply and demand) Note this carefully. Normally housing prices rise because incomes rise. Increased productivity = higher incomes = more demand for housing = higher house prices. That is the normal market function. However, the Fed artificially raised house prices by creating an artificial demand. No one increased productivity. No one actually earned more money to buy a house with. Instead, the Fed interfered by injecting more money into the economy, making it seem like people had earned more. Also, some important steps are missing in the CNBC chain of events. Credit became cheaper everywhere, so why did demand and thus prices only rise in the housing market? In other words, why was this new influx of money all directed towards the housing market? Because 1) Interventions in the market by government creations like Fannie Mae and Freddie Mac had already started artificially raised housing prices, making it an attractive option, and 2) Fannie and Freddie, plus other government agencies had made access to credit for home mortgages easier (ie. They had lowered lending standards, not Wall Street)

- This increased cost of houses meant fewer people could afford them.

- Banks decided to make loans to these people. The question that must be asked here is why? Why would banks make loans to people who couldn’t pay them back? Furthermore, there have always been people who want a house but can’t afford it. So what is different about this situation? See #16 below

- Getting a housing loan used to be very, very difficult (@14:30). People were subject to incredible scrutiny to decide if you could pay back the loan. What changed this?

- “Our industry… has been driven by small and medium sized mortgage bankers that deal with Fannie and Freddie.

- Fannie and Freddie, created by Congress, buy home loans from mortgage lenders.

- Fannie and Freddie then receive the mortgage payments from people. They pool this money and sell it in shares for investment called the “Mortgage Backed Security” that big institutions like pension funds learn to love.

- @16:50 “We were used to being led by Fannie and Freddie. We got our rules from those guys, and that’s what we did.” Note what a big player Fannie/Freddie are. And note that they set the rules.

- Fannie/Freddie in penalty box, Wall Street took over so that small mortgage loaners could “bend the rules” and make loans to people who couldn’t pay them. There’s no other way to put this: CNBC is lying. Fannie and Freddie, and other government agencies, were the ones who “bent the rules.” See this 1999 NYTimes article talking about Fannie/Freddie’s push to lower standards http://www.nytimes.com/1999/09/30/business/fannie-mae-eases-credit-to-aid-mortgage-lending.html Read Ron Paul’s warning before Congress about Fannie and Freddie in 2003 http://www.lewrockwell.com/paul/paul128.html In addition, banks were threatened with discrimination lawsuits if they did not lend to minorities they felt did not meet lending requirements: http://www.independent.org/pdf/policy_reports/2008-10-03-trainwreck.pdf

- @18:40 “The mortgage market caught fire (grew) because the world was flushed with cash.” (It was flushed with cash because foreign countries who used to be poor became rich by being productive) This is an important point. Why was the world flushed with cash? Was it because the world had suddenly become more productive (as Faber suggests)? No. The world was flushed with cash because the Fed flushed the world with cash. The Fed is connected to the entire world economy, not just the U.S. See Schiff’s video @27:50

- Dallas gave people loans that he knew couldn’t afford it. The only thing stopping him from doing it before was Freddie/Fannie’s rules. Wall Street didn’t have those rules. See #16

- @23:00 In 2002 Bush pushes for more people to own homes. Did Bush just say ‘Hey, it would be nice if more people owned homes?’ No. He, and Congress, and other government agencies interfered in the market to get people into homes (people who couldn’t afford those homes). See Thomas E. Woods’ “Meltdown” and the links in #16

- @24:30 “I didn’t actually understand all the terms in the paperwork, but I just trusted the broker.” That’s stupid. This guy deserves what came to him. He’s not a victim. He was greedy. And the market (though not entirely free) did its job by punishing him for that.

- @27:44 “I did ask, ‘How exactly is this going to work?’ She said ‘Oh we’re going to refinance in 5 years. You’ll be fine.’ Did I get more information? No.” -Her mortgage lender lied on the application about her income. Same thing here. This lady got what she deserved for being greedy and lying. She signed the paperwork. She lied right along with whoever helped her. Did the government regulate her bad behavior by punishing her? No, government rewarded her mistake. See point #53

- @28:30 Wall Street was profiting and so were these new home owners with cash from their homes, “thanks in large part to interest rate cuts engineered by Fed Chairman Alan Greenspan.” Note this well. It is impossible to argue that what happened was the result of the free market because of this point.

- @33:30 “part of the problem here” is that “loan officers” had no training and were not regulated by the state. No, the problem was that fear of losing money – which is what regulates bad decisions like this in the market, was inhibited. See Schiff @32:15

- @38:15 “It was a pretty shocking claim – that Wall Street would knowingly create a market for the worst kinds of mortgages.” Yes, it is a shocking claim. And it’s also not true. See #16

- “Wall Street became intoxicated by the sheer volume of mortgages they could repackage and sell, no matter how toxic the loan.” Which was stupid. See Schiff @7:40 But note two important points: 1) This sheer volume was a direct result of the Fed’s injection into the economy, and 2) They got burned (or would have without government) for their intoxication – which is the market working.

- 39:25 Bush brags about new home construction highest in 20 years. “Home ownership rates the highest ever.” Why is Bush bragging if he had nothing to do with the market? He has a lot to do with it. See this very important 2002 speech here http://www.ronpaul.com/2008-09-26/gw-bush-on-the-housing-boom-oct-2002/ Note Fannie and Freddie’s role in Bush’s speech: “And so what are the barriers that we can deal with here in Washington? Well, probably the single barrier to first-time homeownership is high down payments. People take a look at the down payment, they say that’s too high, I’m not buying. They may have the desire to buy, but they don’t have the wherewithal to handle the down payment . . . I’m proud to report that Fannie Mae has heard the call and, as I understand, it’s about $440 billion over a period of time. They’ve used their influence to create that much capital available for the type of home buyer we’re talking about here.” Fannie and Freddie were the super-weights in the housing industry. None of this could have happened without them – and they were created by Congress (ie. they simply would not exist in a free market). Here is a helpful 2002 article showing how Freddie/Fannie distorted the housing market http://mises.org/daily/986

- Greenspan encouraged mortgage industry to come up with new kinds of loans.

- which resulted in “Pay Option Negative Amortization Adjustable Rate Mortgage”

- @41:20 Mantra was that housing prices had not gone down one year since the Great Depression See Schiff @28:10

- In order to divide up and sell loans, Wall Street had to get them rated You should be aware that these rating agencies are a cartel created by government regulation. There is no competition.

- AAA -> BBB, change in housing market made BBB “safer” – so they lowered standard for AAA

- Rating agency conflict of interest – paid by banks they were rating Same as Review magazines who carry ads by companies they review. This is a common problem – but the market solves that problem. See Schiff @36:55

- Nobody was paying attention to reliability of rating agencies And guess what? Capitalism worked and those companies paid the price (or would have if they hadn’t been bailed out by the government)

- Banks created “Collateral Debt Obligation” CDO – small pieces of lots of different mortgages. They were all betting on the continuing rise of housing prices. Again, see Schiff @28:10. This dependence on rising house prices is a result of the Fed and Fannie/Freddie interfering in the market.

- Norway bought CDOs.”The contents of which were a mystery to them.” Are you noticing a theme here? Making dumb investments that you don’t understand, in the end turn out to be too good to be true and you pay the price. That is the market working, not failing.

- @55:30 Fannie/Freddie plunged into the loans they once shunned (sub-prime). See #16. Faber is lying. Fannie/Freddie never shunned bad loans. They pioneered it.

- @56:30 “Why didn’t you stop yourself from giving out bad loans?” “Because I wouldn’t be able to compete because my volume would go to zero.” “Greed is hard to control, huh?” “There’s nobody there saying, ‘Stop it! We can’t do this anymore, even if we go out of business.” This is the exact opposite of how a free market works. In a free market, you don’t go out of business for making wise choices. Instead you go out of business for making bad business choices like lending to people who can’t pay back. So again, what was interfering with this natural free market function? See Schiff @32:15

- @1:01:34 There’s nothing the Fed could have done to prevent a collapse – that is aside from stopping the growth and causing a recession. Which is what the Fed should have done. WE NEED A RECESSION to recover from the artificial booms created by the Fed.

- Warning sign #1 – it was an unregulated market This is not a warning sign. Government regulation provides a false sense of security. Regulated markets prevent people from worrying. It makes them think it’s safe. See Schiff @39:50

- Warning sign #2 – housing prices rising much faster than income This is a correct warning sign and, again, these rising prices are a direct result of government interference in the market (both the Fed lowering interest rates and the various direct government interferences in the housing market).

- Wall Street sellers were fresh out of college. When asked “What if these are bad and you can’t sell anymore?” He said “It will never stop.” And guess what? The people who hired that idiot paid the price (or they would have if the government had let capitalism do its job).

- @1:08:30 How do banks get people to buy CDOs with bad loans? Get them a AAA rating.

- @1:09:30 No one I met with thought it was remotely possible home prices could go down. And those people paid the price for their poor estimations. Those who saw that rising house prices were phony made a profit. That is capitalism rewarding safe practices and punishing unsafe practices. Government rewards mistakes like this, not the free market.

- @1:10:00 It was easy to break the rating rules and make a crappy loan a AAA. “There was not a lot of sophistication involved.” Again, they paid the price for that lack of sophistication.

- @1:11:40 Alan Greenspan couldn’t understand CDOs. Neither did Warren Buffet – which is why he didn’t invest in them and why he didn’t lose money in them. That’s the market working. See this 2003 article http://news.bbc.co.uk/2/hi/2817995.stm

- Sub-prime loans started going bad. A very important point here: it was not just sub-prime mortgages that were going bad. Contrary to Faber’s entire premise, sub-prime loans were not the root problem. Prime loans were defaulting as well, and for the same reason – they were depending on the continued, unsustainable, artificial rising price of houses. See “Anatomy of a Train Wreck” PDF link above and “Meltdown” pp.22-23

- Wall Street stopped buying. (ie. The market was working)

- Sub-prime lenders stopped lending.

- Nobody could get a loan. Good.

- Which resulted in decreased housing demand.

- Which stopped rising housing prices. Faber has this backwards. He says sub-prime defaults brought housing prices down. This is not true. Falling housing prices caused both prime and sub-prime defaults. If housing prices had continued to increase at the same rate, sub-prime mortgages would not have defaulted.

- Which meant people could no longer refinance to keep up with their loans. For #46-52 see Schiff @59:00

- @1:19:45 black woman “I’m being held accountable for my bad choices. But who in that industry is being held accountable?… I’m stupid, but you’re guilty. You’re literally guilty.” Wow. And she’s not guilty for lying? It is this absolute lack of personal responsibility that creates this mess in the first place. People naively think we have reached a certain place in the progress of society where we should no longer have to actually worry about making catastrophic, bad decisions. There will always be a safety net, so I don’t have to worry. This is what “moral hazard” refers to. It is this idea that you are not really at risk for decisions that you make in life. There will always be a safety net to catch you or a safety regulation to keep you from making bad decisions. For example, see Schiff’s comments about FDIC @38:13. Also, Wall Street was held accountable by the market, which is why some banks were going to fail without government intervention – and that would have been a healthy thing.

- @1:22:45 “Norwhich still has no clue what they invested in.” Which is a good lesson.

- @1:23:05 Wall Street sold all kinds of CDOs, not just mortgage backed CDOs. But when the mortgage CDOs went bad, people started to doubt, and their value went down. Again, this is the market working. Companies mixed good investments with toxic ones and it destroyed their companies (or should have if government didn’t interfere with a bailout)

- @1:23:40 Norway: “We have learned a lot. If things sound too good to be true, they are. I have learned not to trust nice man in Armani suits.” And there you go my friends. That is capitalism.

- @1:24:46 “People borrowed too much. Lenders loaned too much. That will not correct itself until the Darwinian flush. Until there is a flush of people that can’t afford to pay these loans and they get wiped out and home values get back to a level people can afford them. Absolutely. That is always the case. However, the government will not allow this to happen. They will come up with some way to help citizens for making stupid decisions, and the big companies are just “too big to fail.” There will be no Darwinian flush because the government will not allow it. There should have been flushes like this after every bubble – but the government prevented it. See Schiff’s comments @14:08

- Banks began failing. As they should.

- @1:28:00 Greenspan retired in 2006. “Within a year, the euphoria he helped unleash would come to an end.

- “They knew what they were doing. They weren’t dumb. It was simply a failure to get out at the right time.”

- Greenspan: We will be having this conversation again in the future. It will be a long time, but it will happen again. There is no law you can pass to stop it because the flaw is in our human nature. Greenspan is half right. He is right to say there is no law you can pass to prevent people from making stupid choices. It is impossible. Only the market can properly provide the necessary disincentive to making stupid choices. However, he is wrong to say that these booms and busts and meltdowns are the natural result of the free market. They are not. He, as Chair of the Fed, was the direct cause. People will make bad decisions in the free market, but it will not result in “systemic failure.” Only an economy being orchestrated by one entity can cause “systemic failure.” See Schiff @32:15 regarding the “trigger” and see below.

Faber concludes: “Greed runs all through this.” That may be the case, but is that really the answer to why? A few questions would have to be answered first.

- What exactly is greed? Is it the same thing as profit? Is it the same thing as self-interest? (see my post on self-interest https://contrast2.wordpress.com/2008/10/02/self-interest-2/ )

- Was greed somehow involved here where it is not everywhere else, including in government?

The reality is that blaming the crisis on “greed” is like blaming plane crashes on gravity. Certainly planes wouldn’t crash if it wasn’t for gravity. But when thousands of planes fly millions of miles every day without crashing, explaining why a particular plane crashed because of gravity gets you nowhere. Neither does talking about “greed,” which is constant like gravity. (T. Sowell)

Q & A

Q: Did the free market fail in 2008?

A: No.

Q: Then why did all the experts in Washington tell Congress they had to bail out banks or the economy would collapse?

A: Because they’re politicians.

A2: Because they are driven by Keynesian economic theory, which, as stated above, believes that the heart of a good economy is lots and lots of consuming. This false theory believes that if people save their money instead of spend it, then the economy will decline and fail. Thus under the Keynesian view, if big banks failed and therefore caused people to be more careful with their money, people would stop spending and therefore the economy would fail. But this is a false theory. It is good to be wise and to save money. In fact, after an artificial boom created by the Federal Reserve, it is very necessary for there to be a recession where people start saving their money. It is the only way to recover from the government’s manipulation of the market.

A3: Even the specific evidence the Fed brought forward to support their claim that the economy would collapse turned out to be untrue. The Fed said bank lending had frozen, along with interbank lending. This, along with other claims, simply were not true as a study by some economists for the Federal Reserve Bank of Minneapolis showed: http://www.minneapolisfed.org/research/WP/WP666.pdf

A4: A great quote from Thomas Woods: “For whatever reason, Secretary Paulson suddenly decided that this (purchasing toxic assets) was not the way to spend the hundreds of billions of dollars he had asked for. Instead, it was now the consumer credit markets that needed to be propped up. “Illiquidity in this sector is raising the cost and reducing the availability of car loans, student loans and credit cards,” Paulson warned. Because if there’s one thing Americans need more of, it’s credit card offers. And the cruel fate of having to keep your car for an additional year or two instead of buying a new one – it’s just too terrible to contemplate.

Should consumer credit actually become slightly more difficult to come by, full-fledged panic does not seem like the sensible response. The market would thereby be saying that Americans needed to start saving a little, instead of buying another plasma TV on credit. But our rulers cannot leave well enough alone. The very thought never occurs to them. If they weren’t looting the general public to bail out some wealth destroyer they would hardly know what to do with themselves.”

Q: So you think its good for big banks to fail?

A: Yes. If they have made bad business decisions, then they should pay the price. That is the sign of a healthy free market. Isn’t this exactly what people are complaining about? Aren’t people saying the free market failed because greedy Wall Street wasn’t punished? Well they were, except that government stepped in and prevented them from receiving the consequences for their decisions (like big boys). The economy would not stop. See Schiff’s comments

Q: But what about all those innocent people who had their retirements invested in Wall Street?

A: Those people are not innocent. They chose to place their savings in Wall Street. They took a risk. There is no such thing as a free lunch. There is no such thing as a safe investment. Every investment is a risk. No one has a right to retirement just because they invested in the stock market. It is a very sad thing to see happen, but the fact that so many people think Wall Street is a relatively safe investment is because the government has continually intervened to protect it from the consequences of bad decisions. The effect is cumulative. (The same is true for our trust in banks for simply keeping our deposits secure. The FDIC creates a false sense of security. Whether or not a bank conducts trustworthy business should be a factor in our choosing a bank – rather than if the bank lets you put your favorite picture on your debit card. See Schiff)

Q: Is Wall Street the heart of the free market?

A: No.

Q: But aren’t all these booms and busts proof that the free market is unstable?

A: No. Those booms and busts are a direct result of the Federal Reserve’s manipulation of the market.

Q: You seem to place a lot of blame on the Federal Reserve. Are you one of those weirdo conspiracy theorists?

A: No. Some people believe the creation of the Federal Reserve was part of a global conspiracy. That may or may not be true. It could just as easily have been the creation of Wall Street bankers who wanted a way to cheat the market, or maybe it was even created by well-intentioned, but mistaken politicians. Either way, the Federal Reserve is to blame for the boom and bust cycle.

Conclusion

So, the problem, and the real problem that we have, of course, is now that the bubble has burst — first from the stock market, now the real-estate market — and now that we’re having this massive recession, which is just getting started, we’ve barely gotten a taste of it. But, unfortunately, all the blame is on the free market. All the blame is on capitalism. It’s because there wasn’t enough regulation. There was too much greed. Right?

And Alan Greenspan, or, not Alan Greenspan. President Bush, in one of his speeches, said that Wall Street got drunk. And he was right, they were drunk. So was Main Street. The whole country was drunk. But what he doesn’t point out is, where’d they get the alcohol? Why were they drunk?

Obviously, Greenspan poured the alcohol, the Fed got everybody drunk, and the government helped out with their moral hazards, and the tax codes, and all the incentives and disincentives they put in — all the various ways that they interfered with the free market and removed the necessary balances that would have existed, that would have kept all this from happening.

We’ve always had greedy people. Everybody’s been greedy, not just Wall Street. But all of a sudden everybody was greedy all at the same time? Can’t they understand there’s a trigger for this, there’s a reason that everybody acted this way?

Normally, when people are greedy, they’re also fearful of loss, and people’s fear of loss overcomes their greed and checks their behavior. But what the government did, repeatedly, was try to remove the fear — they tried to make speculating as riskless as possible.

First, they provided us with almost costless money with which to speculate. And then they created the idea or the Greenspan Put. But whenever there’s a problem, don’t worry, the government is going to rescue you.

The government’s not going to let the stock market go down. The government’s not going to let your bets go bad, so go ahead and keep placing them. That was the idea, that was the mentality. It was nothing that the free market did.

Additional Resources:

- Meltdown: A Free Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse Thomas E. Woods

- The Great Boom and Bust | Interview with Ben Powell (5 minutes)

- The Housing Boom and Bust with Ben Powell (1 hour lecture) very helpful, very clear explanation

- Thomas E. Woods on C-SPAN 2 Book-TV

- Meltdown Lecture at University of Colorado

- The Bailout Reader

- The Depression Reader

- Skyscrapers and Business Cycles, or How You Can Predict the Next Economic Crisis

- Various Mises Institute Lectures on the Business Cycle

- Don’t Bail Them Out

Please let me know if you have found this helpful and if I can clarify anything.